You’ve probably heard a thousand analogies explaining FinTech and yet perhaps at some point, you’ve wondered, “Hey…what is it even about? How does this whole thing work?”

Financial technology, abbreviated as FinTech, is bringing about a massive change in how organizations large and small treat, process, and perceive financial services such as insurance, lending, payments, and wealth management.

It encompasses everything from infrastructure (Blockchain/Bitcoin) to credit, saving bonds, payments, and other underlying financial services.

An industry moving so fast that today’s predictions are often tomorrow’s realities. That is where the concern for the data security for banking and financial services is custom.

Growth of the Fintech Industry

In 2024, fintech revenues increased by 21% year-over-year, surpassing the traditional financial services sector's growth of 6%. Additionally, 69% of publicly listed fintech companies reported profits, up from less than 50% the previous year [source].

As of 2024, there are over 29,955 fintech startups worldwide, more than doubling from 12,131 in 2020 [source].

In 2024, the Americas led fintech investments with $63.8 billion, followed by EMEA at $20.3 billion and Asia-Pacific at $11.4 billion [source].

As users lean on these technologies —more concerned about availing medical care than securing their data—the cyber pirates are having their Coachella moment.

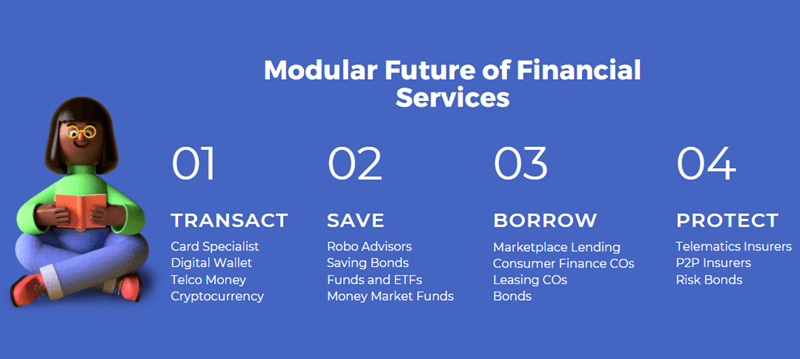

The Growing Modularization of Financial Services

What makes FinTech, in particular, so prone to data vulnerability?

One word. Modularization of financial services.

Compared to the past, where IT teams in traditional banks had more runway to roll out new services with longer shelf life, technology today has the shelf life of a banana.

Furthermore, the IT teams are now busier grappling with compliance and regulatory updates and prefer to leverage highly specialized and technically sophisticated third-party providers—often on a plug and play basis—to deliver their underlying services, leading to the modularization of financial services.

For example, A bank needing to venture into digital lending will likely hire a third-party FinTech, which has the algorithm and the credit scoring model that can plug into the bank’s system and do what’s required to roll out the service quickly.

Similarly, activities like origination, analytics, compliance and risk management, customer due diligence and onboarding—are now managed by separate providers—unlike in the past where the bank provided all these financial services.

So now, while you have an account with the bank, multiple FinTech providers that the banks are outsourcing services from have access to your data.

PS: Many of these fintechs are not regulated by any financial services regulator.

Data-Driven Difficulties

FinTech rides upon a lot of PII (everything from Social Security numbers to credit card details). This data is further digitalized, processed, and shared for granular analysis and insights—in turn making it more vulnerable.

According to data and ethics expert Dr. Gemma Galdon Clavell, there are five major moments where data is most vulnerable: collection, storage, sharing, analysis, and deletion.

This fact is further cemented by the number from ImmuniWeb that states almost 98% of the top 100 global FinTech startups are vulnerable to major cyberattacks, including phishing, app security attacks on mobile and web, etc.

Here are the top three data security challenges that the FinTech sector faces:

1. Data Ubiquity

FinTech firms have a thin line to walk—between the opportunity of harnessing a raging ocean of customer data that can be analyzed and processed to create niche products and services—and the challenge of meeting regulatory compliance and privacy requirements—particularly around PII and financial information.

Protecting this data and providing it to customers and third parties securely and when required remains a top concern for businesses.

2. Data Sharing

Economies that embrace data sharing for finance could see GDP gains of between 1 and 5 percent by 2030. Data obviously remains one of the most recyclable commodities on Earth.

While active data sharing between traditional financial institutions and contemporary businesses is the backbone for developing better FinTech products and services, it also creates multiple points for data interception.

The FinTech industry needs more robust mechanisms around acquiring consumer consent regarding data sharing, reuse & implementing technologies, and processes for data life cycle management—ensuring it remains out of bounds to the grey market.

3. Application Breaches

FinTech applications are pivotal to FinTech services—gathering sensitive data such as end-user credentials to perform multiple finance-oriented tasks.

These apps are also one of the prime attack vectors.

Given they’re user-facing, they’re easier to bypass as compared to the company’s network. And if they get access to your app, it’s only a matter of time before they get access to your data.

By now, you must’ve noticed how most (if not all) of these risks revolve around data, and that quite explains why a robust encryption strategy is a no-brainer for FinTech enthusiasts.

Change Starts Now

Numbers from a recent study indicate that almost three-quarters of users will consider switching banks if their current financial institution fails to keep up with their FinTech app.

From a consumer’s standpoint, security is an integral part of FinTech solutions— the onus of providing security lies with the FinTech firm. Let me translate that in English—data privacy and security are only going to be more pivotal in winning the customer’s confidence and catapulting the adoption of FinTech.

The time for action is now.

Partnering with companies that offer additional data privacy and security solutions can build more trust and value to any FinTech service. Look for solutions that protect your consumers’ privacy with features like data encryption, key management, HSL 140-2 L3 grade security, identity theft protection, and other features that safeguard what consumers value most.

Fortanix is a pioneer in this space and has been working with the likes of PayPal, Token.io, and NEC. I strongly encourage you to sign up for a free trial and see how providing such security features to your customers will not only build value for your company but trust with your consumers.