As the world of Web3 and decentralized finance grows, more and more people are using crypto wallets to store their digital assets. You will hear a lot of different words when you start to learn about blockchain technology and, perhaps, its highest-profile incarnation – Bitcoin.

But what is a crypto wallet, and how does it work?

A crypto wallet is a piece of software that stores information, just like a regular wallet can store your cash and cards. This tool saves both public and private keys and can be used with several blockchains to manage access to your digital assets. This communication can be used to trade or transfer digital currency and other forms of assets, such as non-fungible tokens (NFTs).

Wallets can be cold or warm. Custodial or non-custodial. If you're confused by all the different kinds of crypto wallets out there, you've come to the right place. A lot of people have questions about this and are concerned about the security of their digital assets.

TL, DR – Key Takeaways:

- A "crypto wallet" is a digital wallet that you will need if you use cryptocurrency or manage digital assets. With these wallets, you can store, send, and receive digital assets.

- Wallets are like browsers for the internet; they make it easier to use the technology underneath. In this situation, a wallet makes using a blockchain easier.

- A digital wallet works just like a normal bank account. Because you have the login information, you can get into your account (private key). But if you share the routing number, which is also called the public key, you can send and receive assets.

- Putting a lot of digital assets in one wallet is risky, so most people should use both cold and hot wallets. This can improve privacy and aid in risk management (if you lose one private key, you won't lose access to all of your wallets, for example).

- Storing your digital assets is an important part of investing in cryptocurrencies, and as the decentralized finance field continues to grow, non-custodial wallets are becoming more popular.

- With a non-custodial wallet, your private keys are not accessible to a third-party, only you have access to them. These keys allow you, alone, to manage and verify ownership of your cryptocurrency.

- The "Non-Custodial Warm Wallet" from Fortanix is just one of many user-friendly and secure options to store your digital assets, confident in their security.

How do wallets for crypto work?

Most crypto wallet users don't know how they function. Crypto wallets don't hold real-world money (or fiat currency). Crypto wallets carry both private and public cryptographic keys. A user may transfer digital assets or do other things, using these keys to prove their identity.

When someone sends you bitcoins, they give you the right to own those bitcoins by signing the transaction using their keys. The coin(s) will be added to your wallet after a valid signature is provided.

To deposit cryptocurrency into a wallet, the public key is required. Verifying transactions and establishing ownership of a blockchain address requires the private key. To "unlock" a transaction and verify that you are now the owner of, say, one bitcoin (BTC), you will need a private key. Wallets are like bank accounts. You've probably used a bank account number to transmit or receive money. This number has been used to pay for services and transfer money to friends and relatives.

This number has been used to pay for services and transfer money to friends and relatives. For added security and ease of use, choosing the best USDT wallet can help protect your funds by offering advanced encryption and features tailored for managing digital assets like USDT.

Related Read: Thinking out Loud: NFTs, Crypto and Beyond

If someone wants to send you a bitcoin, you tell them your wallet's address. No two digital identifiers are the same, much as with bank accounts, thus your money is associated with a wallet that is unique to you.

No matter how many wallets you make, you can always make more. Many digital addresses are made up of a mix of letters, numbers, and both small and capital letters.

Most of the time, blockchains make their transactions public, so it's easy to see how much money is in each cryptocurrency wallet. But the crypto wallet will never reveal in the real world who the owner is.

You wouldn't get very far as a normal user without a crypto wallet. But user’s knowledge, today, could be compared to the early days of the internet in the 1990s, when people didn't know how they would ever be able to use the technology because it was so hard to comprehend. Then browsers came along.

People who didn't know much about computers could use this new type of application to access the Internet in a simple and easy way. Soon after, there was a Cambrian explosion, and millions of people could get on the Internet using a wide range of browsers. After a few decades, more than 5 billion people are now connected to the Internet. Almost 70% of the people in the world now use browsers every day to get on the Internet and to seek the information they need.

In the same way, crypto assets are still in the early stage of adoption. When crypto wallets get better and make it easier to use decentralized services built on blockchain technology, billions of people will find themselves using them as part of their daily lives.

What does a Crypto Wallet hold?

A wallet's main job is to hold and manage cryptocurrency and digital assets. Even though digital wallets are often compared to the wallets we carry in our pockets, they don't actually hold any crypto assets. There is no such thing as a bitcoin in the physical domain, it's just a line in the blockchain ledger for Bitcoin.

seed phrase and the private keys that go with the actual crypto assets are kept in a crypto wallet. If you lose access to your digital wallet and can't get it back, your cryptocurrency will still be on the blockchain, but you won't be able to use it because you've lost the private keys. Hence, your private keys must be properly protected to avoid disaster.

Hot vs. Cold vs. Warm Crypto Wallets

Crypto wallets can be classified according to the difference between "hot" and "cold" wallets, or, if you prefer, "online" and "offline" wallets.

Hot wallets are places where you can store digital currency that can be connected to the Internet in any way.

As we talked about in the chapter before this one on crypto storage, "hot" wallets are those that store private keys digitally on a device that is connected to the Internet. Even though most hot wallets use advanced encryption to keep your private keys safe, there is still a chance that their code has bugs or security holes. Most hacks that have worked have been done on what are called "hot wallets", leading to huge losses for customers and blockchain operators.

You shouldn't keep a lot of crypto assets in "hot wallets" because it's not a good way to protect your money. They are vulnerable to attack and put your assets at risk.

Hot Crypto Wallets

Connection to the Internet is one of the primary differences between a hot wallet and a cold wallet. Unlike cold wallets, which are not linked to the Internet, hot wallets are. As a result, hackers will have an easier time gaining access to money stored in hot wallets.

Hot wallet types include:

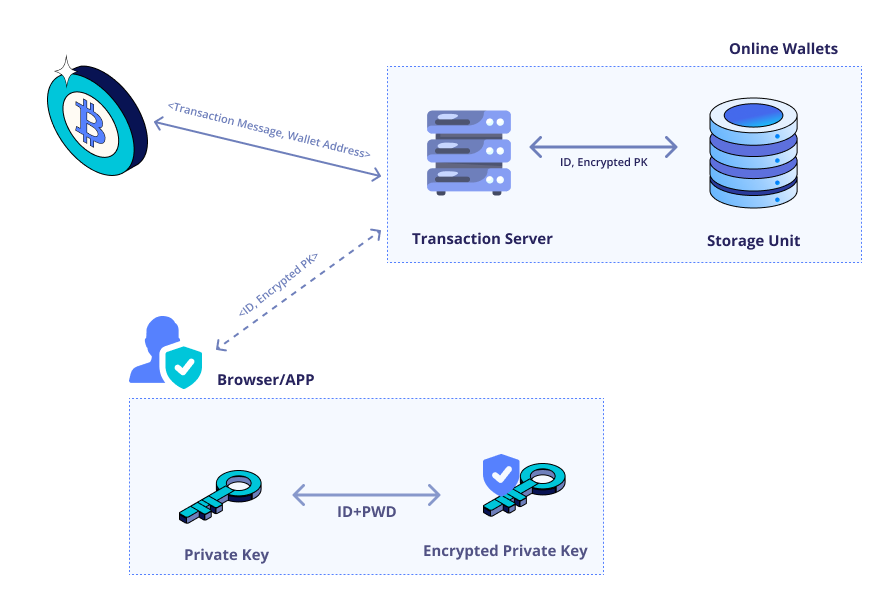

- Online wallets

Even though these wallets are easy to use and convenient, they are controlled by third parties, which makes them less safe. These types of wallets hold private keys, but they could be accessed by a malicious insider or accessed via an attack on the service provider. - Smartphone wallets

A smartphone app will be required to operate a mobile wallet. Even if they don't have a lot of room, the fact that it can be used anywhere is a major selling point. - Desktop wallets

You will get this wallet by downloading it and installing it on your PC. The digital wallet can be accessed by just one computer at a time. Even though it provides the greatest possible level of protection, if your computer crashes or is infected by malware, you run the risk of having your wallet stolen.

As long as you have an internet connection, you can access your private keys in a hot wallet. If a computer network is vulnerable to hackers and malware programmers – which they generally are, using a hot wallet is a bad idea. But the threats may be reduced by using a hot wallet with sufficient encryption, or by using devices that store private keys in a secure location.

Bitcoin investors may have a variety of reasons for wishing to connect or disconnect from the Internet. Because of this, it's usual for bitcoin owners to maintain several wallets, including both hot and cold ones.

Cold Crypto Wallets

As we said at the beginning of this section, a cold wallet has nothing to do with the internet. But they're less convenient to use than hot wallets. A piece of paper or metal with the cryptographic key written or engraved on it may be used for cold storage.

Types of cold wallets include:

- Paper wallets

The private and public keys are kept separately in a paper wallet. Because hackers and phishers can't get their hands on these keys, this method is more secure than using a hot wallet to store your money. Instead, it increases the likelihood that the paper will be misplaced or destroyed, making it impossible to reclaim any of the money. The keys are printed for the user, which makes it easy and clear to send bitcoin. To spend money, you will need to move it from your paper wallet to your software wallet. This is called "sweeping." - Hardware Wallets

When it comes to hardware wallets, the name says it all: it's an actual piece of hardware, similar to a USB stick. Hardware wallets are more secure for keeping information offline, despite the fact that they may be used to perform transactions online. The use of a personal identification number (PIN) allows hardware wallets to be interoperable with a wide variety of interfaces and currencies, while preventing unauthorized use.

Warm Crypto wallets

Warm wallets are similar to hot wallets, but they add an extra layer of security. The keys are kept online, and transactions can be made automatically. However, the transaction must be signed and sent to the blockchain by an actual human being.

Which is Better: Hot, Cold or Warm Crypto Wallets?

It's up to you to decide which method is best for you based on your specific needs. If you plan to trade often, a "hot wallet" is a fantastic choice since it provides rapid and easy access.

A cold wallet, on the other hand, is the ideal solution if you have a big quantity of crypto assets and choose security above convenience. When compared to cold wallets, warm wallets are more efficient, but they still need human interaction to verify transactions.

Custodial vs. Non-Custodial Wallets

Custodial Crypto Wallet: Advantages & Disadvantages

A custodial exchange crypto wallet is where you're most likely to find your first crypto buy, but this isn't true for all web-based crypto wallets. The exchange acts as a custodian for your cash, keeping your private keys safe while you're away. Your assets should be kept in cold storage hardware by a trustworthy custodial wallet, such those provided by major U.S. crypto exchanges, to ensure maximum security.

While you're away, the exchange will care after your funds and keep your private keys secure. A reputable custodial wallet, such as those provided by the main US crypto exchanges, should hold your funds on cold storage hardware in order to ensure their safety.

In certain circles, people debate what blockchain is, how to create a blockchain wallet, and which cryptocurrency will become the world's future money. Choosing a wallet depends on who has access to the private key: a comparison of Custodial vs. Non-Custodial wallets is an important starting point. In the remainder of this post, we'll go into further depth regarding the role of third-party custody in digital asset management.

Non-custodial Crypto wallets: Owning your assets

Wallets that don't contain your keys or cash are a safer option. A non-custodial wallet, which does not involve a third party, is preferred by many users over an exchange account.

It is significantly easier to implement this concept when using wallets that do not contain any actual cash. Non-custodial wallets let you to choose your own seed phrase. You are the only one who has access to and control over your money if it is not in your wallet.

You are the only one who can give or receive money. You are the only one who has the authority to spend your cash. Another benefit is that they are impervious to removal or freezing. Wallets that do not need locking are available in a variety of sizes and forms.

A custodial wallet's ease of use and lack of responsibilities may make it less secure than a non-custodial wallet, yet many individuals prefer it anyway because they are either unfamiliar or ignorant of the associated risks.

You are the only one who has access to your private keys if you use a wallet that does not store them. These keys allow you to control and verify ownership of your digital assets. Wallets that don't retain your money eliminate the need for third-party trust. As a result, it's up to you to make sure you don't lose your money and that you don't forget your keys.

A custodial wallet entrusts the safekeeping of your private keys to a third party. This means you're handing over control of your money to someone else, and you're putting your faith in them to keep it secure and return it to you if you ever need it. It is still necessary to trust the cryptocurrency exchange, which is generally a custodian, even if you are less accountable for your money.

There are now a large number of custodial wallets available for online exchanges.

How secure are Crypto wallets?

These cryptocurrency wallets have many layers of protection built into them. There will be a difference in the degree of security provided by your wallet and that of your service provider. The most typical error that people make with their wallets is transferring money to an unauthorized person, in error, or due to criminal activity.

If the other individual does not want to return the money to you, it will be difficult, or impossible, to retrieve it. Don't put a lot of assets in your online wallet, because that could be risky. If your computer breaks down or you lose it, you can protect yourself by using paper or a USB. Having the most recent version of your software will protect you the best and a backup to recover keys if the worst happens.

As an extra layer of security, many users use complicated passwords and need to provide passwords for all transfers.

Fortanix “Non-Custodial Warm Wallet”

As the world leader in the deployment of Trusted Execution Environments for Confidential Computing, Fortanix enables B2C businesses to secure cryptocurrency wallets while bundling additional functionality with them which makes them more secure and non-custodial.

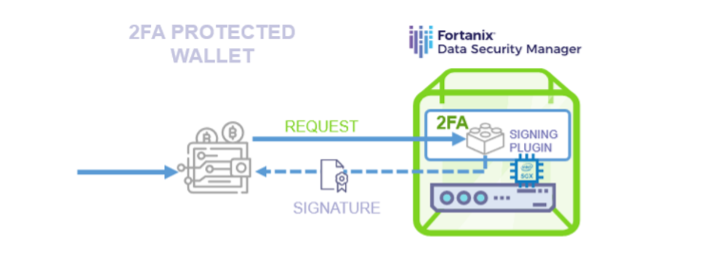

The Fortanix “Non-Custodial Warm Wallet” solution provides an additional layer of security to cryptocurrency wallets by incorporating a second factor of authentication (2FA) using Time-based One-Time Passwords (TOTP). The solution forms part of the Fortanix Secure Web3 Infrastructure suite of tools and is provided as a managed service.

The Fortanix “Non-Custodial Warm Wallet” solution enables B2C cryptocurrency businesses to ensure that their customers’ assets are not transferred without their explicit consent. This assurance reduces the trust barrier for B2C cryptocurrency businesses. It also reduces operational risks for wallet providers and asset owners.

Top Benefits of the Fortanix “Non-Custodial Warm Wallet”

- Ease of Use

To support easy integration, the Fortanix Non-Custodial Warm Wallet solution includes an SDK (Software Development Kit) module which integrates seamlessly with the web3.js Ethereum SDK. - Improved Security

The Fortanix Non-Custodial Warm Wallet solution offers several benefits.By moving the 2FA system to a highly secure Confidential Computing environment, we have significantly improved the security of the entire system. - Reduced Trust Barrier

Our solution ensures that a compromised wallet backend system does not lead to loss of end users’ assets. This means that end users can trust wallet providers more. - Reduced Operational Risk

Our design reduces operational risk dramatically. Cryptocurrency businesses can demonstrate to regulators, insurance providers or other authorities that users’ assets cannot be spent without the explicit consent of the user.

Conclusion:

In order to protect your bitcoin or any other form of digital asset, you must make a choice between a custodial and non-custodial wallet. Custodial exchange accounts are preferred by some, while non-custodial wallets are preferred by others, and a few people use a mix of the two.

Your decision on whether you choose a hot or cold wallet and whether to split your cryptocurrency assets over many wallets will also have an impact on how manage your digital asset portfolio. The most important thing is to adhere to the most up-to-date security guidelines, no matter what you decide.

A common saying in the industry is, "If you don't have your keys, you don't have your Bitcoin." Obviously, it also works for all other cryptocurrencies. The choice is ultimately up to you, and the Fortanix "Non-Custodial Warm Wallet" is one user-friendly and secure option when it comes to having complete ownership of your digital assets.